Feie Calculator for Beginners

Wiki Article

The Ultimate Guide To Feie Calculator

Table of ContentsFeie Calculator Things To Know Before You Get ThisGet This Report about Feie CalculatorThe smart Trick of Feie Calculator That Nobody is DiscussingThe Only Guide to Feie CalculatorHow Feie Calculator can Save You Time, Stress, and Money.

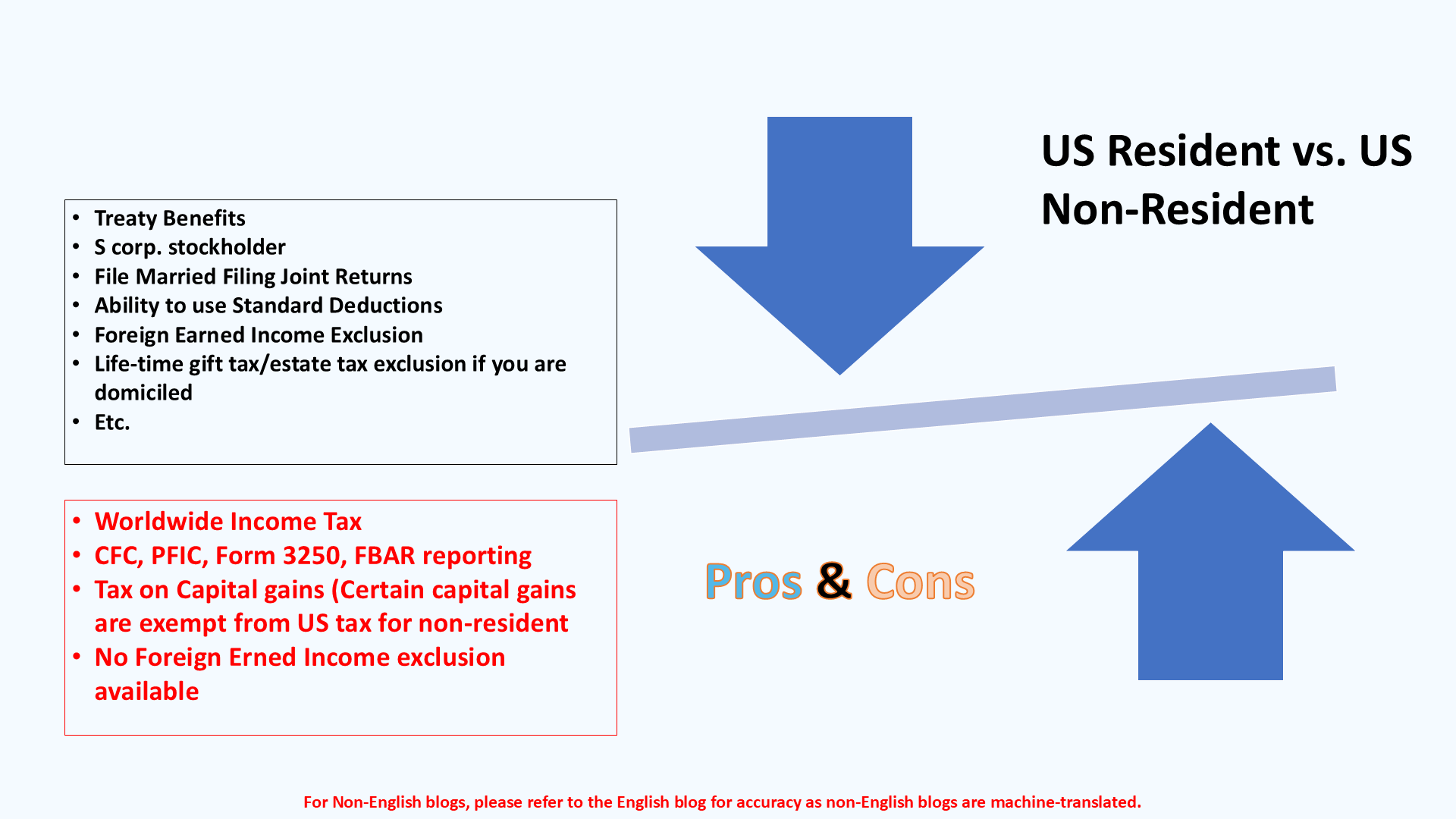

US expats aren't limited only to expat-specific tax breaks. Typically, they can claim numerous of the exact same tax obligation credit scores and reductions as they would in the United States, including the Child Tax Credit History (CTC) and the Life Time Understanding Credit Score (LLC). It's possible for the FEIE to lower your AGI a lot that you don't get certain tax obligation debts, however, so you'll need to confirm your eligibility.

The tax code claims that if you're an U.S. citizen or a resident alien of the United States and you live abroad, the internal revenue service taxes your worldwide income. You make it, they exhaust it regardless of where you make it. But you do obtain a wonderful exemption for tax obligation year 2024.

For 2024, the optimal exclusion has been raised to $126,500. There is additionally an amount of certified real estate expenditures eligible for exclusion.

A Biased View of Feie Calculator

You'll have to figure the exclusion first, due to the fact that it's restricted to your foreign gained revenue minus any international real estate exclusion you assert. To get the international gained income exclusion, the international housing exclusion or the international real estate deduction, your tax obligation home should be in an international nation, and you need to be just one of the following: An authentic resident of a foreign nation for a continuous period that consists of a whole tax year (Bona Fide Resident Examination).If you state to the international federal government that you are not a homeowner, the examination is not satisfied. Qualification for the exemption could likewise be impacted by some tax treaties.

For U.S. residents living abroad or making earnings from international sources, concerns frequently occur on just how the united state tax system uses to them and exactly how they can guarantee compliance while reducing tax obligation responsibility. From understanding what foreign revenue is to browsing different tax return and deductions, it is crucial for accountants to comprehend the ins and outs of united state

Dive to International revenue is specified as any type of revenue made from resources beyond the United States. It encompasses a broad array of financial tasks, including yet not limited to: Wages and salaries gained while working abroad Bonuses, allowances, and advantages supplied by international employers Self-employment income originated from foreign businesses Passion made from international savings account or bonds Dividends from foreign corporations Capital gains from the sale of international assets, such as actual estate or supplies Profits from leasing foreign buildings Income generated by foreign businesses or collaborations in which you have a rate of interest Any type of other earnings made from international resources, such as nobilities, spousal support, or wagering earnings International made income is defined as earnings earned with labor or solutions while living and operating in a foreign country.

It's essential to identify international gained earnings from various other sorts of international income, as the Foreign Earned Earnings Exclusion (FEIE), a valuable united state tax benefit, particularly relates to this classification. Investment income, rental earnings, and easy earnings from international resources do not get approved for the FEIE - Physical Presence Test for FEIE. These kinds of income may be subject to different tax therapy

resident alien who is a person or national of a nation with which the United States has an earnings tax obligation treaty effectively and who is an authentic homeowner of an international country or nations for a continuous duration that includes a whole tax obligation year, or A united state citizen or an U.S.

The Buzz on Feie Calculator

Foreign gained earnings. You should have earned revenue from employment or self-employment in a foreign country. Easy income, such as passion, dividends, and rental earnings, does not qualify for the FEIE. Tax home. You must have a tax obligation home in a foreign country. Your tax home is normally the place where you perform your regular organization activities and keep your primary economic rate of interests.This credit history can offset your United state tax obligation responsibility on foreign income that is not eligible for the FEIE, such as investment income or More Info easy earnings. If you do, you'll then file additional tax obligation kinds (Kind 2555 for the FEIE and Kind 1116 for the FTC) and connect them to Type 1040.

The Ultimate Guide To Feie Calculator

The Foreign Earned Income Exemption (FEIE) enables eligible people to omit a portion of their foreign gained earnings from U.S. taxes. This exclusion can considerably reduce or remove the U.S. tax obligation responsibility on foreign revenue. Nonetheless, the details amount of international income that is tax-free in the united state under the FEIE can alter annually because of inflation changes.Report this wiki page